- Products

- Solutions

- Developers

- Support

- About

- Login

- Blog

Ensuring your business uses the correct sales and use taxes starts with an address and access to up-to-date rates. FastTax has both.

Customer Support

Uptime Guarantee

Support Engineers

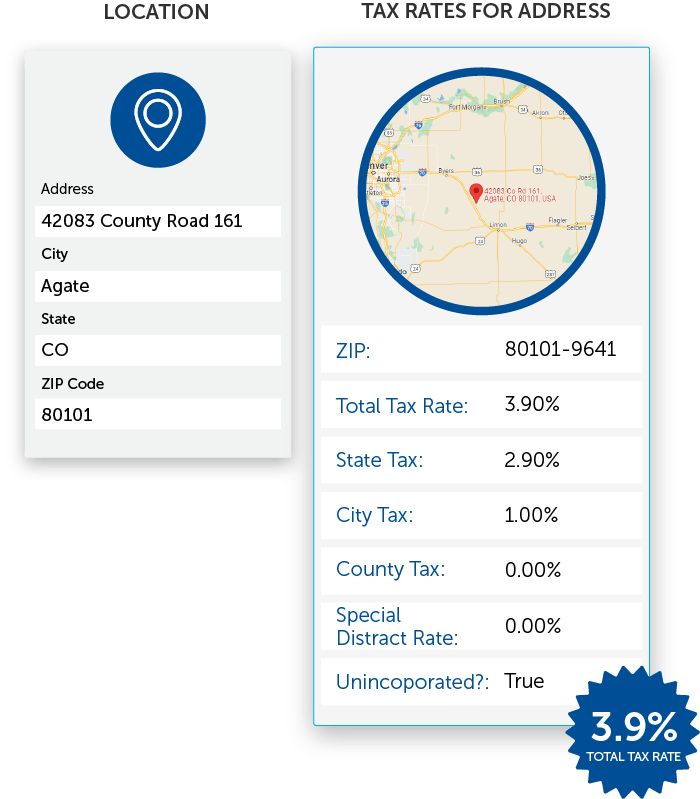

Returns tax rate data specific to US/Canada address or region, including state, city, county, district and special district rates.

Returns match code with flag for whether tax rates for input address are provided at Address or Zip Code levels.

Returns IsUnincorporated Notes flag to determine unincorporated areas, and ignore City or City District level tax rates.

Provides lists of tax-exempt items as well as other associated tax information as string-value pairs.

© 2024 Service Objects, Inc. All rights reserved.

We use cookies to enhance your browsing experience.

Cookies, tracking pixels, and similar tech are small data files served by our platform and stored on your device. They help with site operation, personalization, and may track your usage for targeted ads on other sites.

By using our site, you agree to our cookie use.

Third-party services may also deploy cookies, including Google, Facebook, and others. These services collect anonymous data like IP addresses and device IDs for analytics and site functionality.