- Products

- Solutions

- Developers

- Support

- About

- Login

- Blog

Ensuring your business uses the correct sales and use taxes starts with an address and access to up-to-date rates. FastTax has both.

Accurate sales and use taxes are essential for businesses to ensure compliance with complex tax regulations, avoid costly penalties, and build trust with customers. In today’s dynamic tax landscape, incorrect tax calculations can lead to underpayments, overpayments, or legal challenges.

By using our precise and automated tax solutions, businesses can streamline their processes, reduce errors, and focus on growth, all while ensuring they meet their tax obligations with confidence.

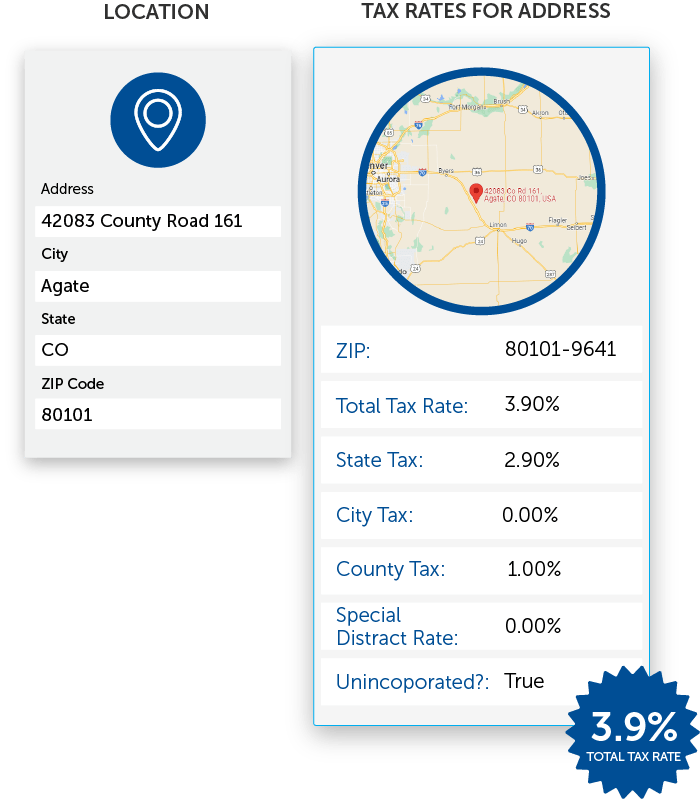

Our FastTax service starts with our certified Address Validation engine, establishing valid addresses to ensure correct tax rates for both US and Canada. Using the address, the service also identifies incorporated and unincorporated areas, which is essential for areas that have multiple tax jurisdictions.

Returns tax rate data specific to US/Canada address or region, including state, city, county, district and special district rates.

Returns match code with flag for whether tax rates for input address are provided at Address or Zip Code levels.

Returns IsUnincorporated Notes flag to determine unincorporated areas, and ignore City or City District level tax rates.

Provides lists of tax-exempt items as well as other associated tax information as string-value pairs.

Uptime Guarantee

Customer Support

Support Engineers

FastTax leverages the power of our Certified Address Validation engine to capture accurate address information and geo-coordinates to deliver up-to-date and accurate tax data in the US and Canada. Accuracy ensures that up-to-date tax rates are applied at the time of purchase.

Our real-time service is easily integrated with leading ecommerce platforms, ERPs and billing software, ensuring that you have up-to-date tax rates and eliminating the need to perform bulk tax rate updates.

© 2025 Service Objects, Inc. All rights reserved.