The primary purpose of our FastTax service is to provide sales and use tax for any US address. One of our key priorities with this service is making sure that its tax data is up to date, and with forty five of the fifty states having sales tax and more with territories, there are a multitude of cities and counties to keep track of for rates. However, we stay vigilant in maintaining the most recent data, and we are constantly looking for ways to improve the implementation of state data into our systems.

Special District Rates

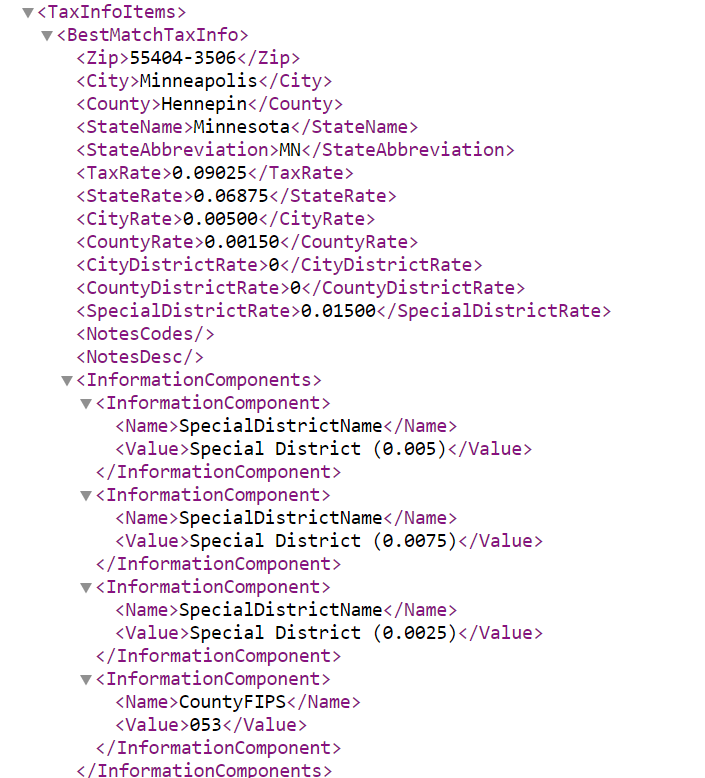

One of the biggest factors that we keep track of is special district rates, which are rates for areas that don’t fit into the normal types of sales/use tax rates like state rate, county rate, and city rate. For example, Minneapolis, as well as a few other areas in the Minnesota metro area, have specific district taxes to provide for transportation and housing. This can be seen in FastTax within the InformationComponents section.

When an address has sales tax rates that come from special districts, FastTax will break down the rates into each individual special district rate. Not every state has special district rates, but it is important to monitor the states that do, to provide the correct sales and use tax rates.

Texas Special District Rates

Texas is the largest state in the US that has sales and use taxes. With 254 counties, the most of any US state, there are far more rates within Texas than with the average state. What complicates this further is that Texas also has 432 special districts that have their own sales and use tax rates. This makes Texas one of the most complex sales/use tax systems of any US state. Despite the complexities of Texas’ districts, we have made recent updates to include these district rate names into FastTax. Now, whenever an address from Texas has a special district, FastTax returns whichever special district taxes are accounted for in the address along with the specific names of each district in the address.

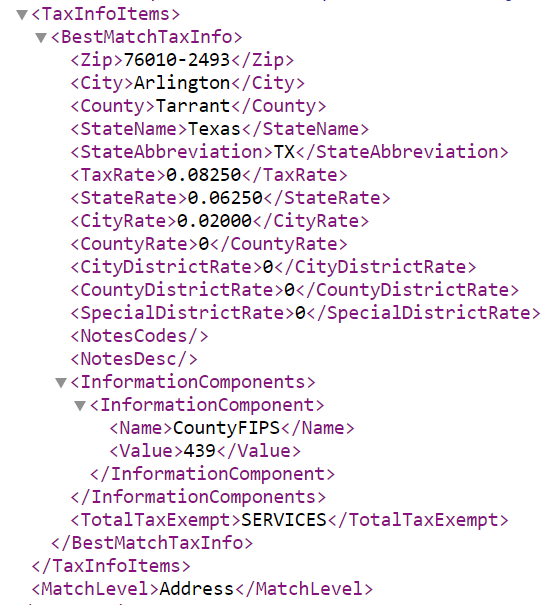

For example, an address in Texas that is not in special district will look like this:

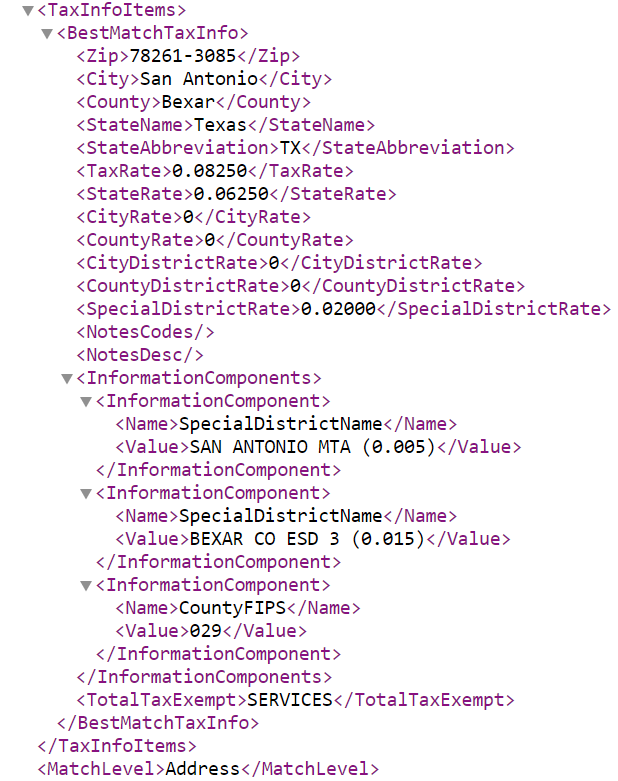

However, for an address in Texas that is in one or more special districts, the output looks a little different:

As with special districts in other states, the InformationComponents section returns the breakdown of every special district rate. These special districts are also named for Texas addresses, using names provided from the Texas Comptroller, which is the government source for Texas sales tax rates. We make sure that our data is as accurate as possible by comparing it to official sources such as these.

Sales and use taxes are both complex and changing, whether by updates to the rates themselves or addition of new tax rates and special districts. FastTax is updated to match these rates, providing the user with up-to-date tax information and insights.