The year 2022 was a wake-up call for businesses across the globe. Customer account fraud emerged as a major threat with losses of over $41 billion. As we closed out 2023, the outlook remains far from optimistic, with projected losses for the year estimated to exceed $48 billion.

The impact of fraudulent customer accounts creates financial losses, drains resources, increases internal costs, and damages your brand. Additionally, new digital services such as digital wallets and Buy Now – Pay Later (BNPL) are also creating new fraud risks. So, how does this threat materialize, and what can businesses do to protect themselves?

The Dangers of Fake Customer Accounts

Often bad customer data comes straight from the customers themselves, as innocent data entry mistakes. However, it is equally simple for bad actors to create fake accounts, which become the perfect launchpad for their fraudulent activities – like a Trojan horse, infiltrating your organization from within.

Here are just two of many recent examples that illustrate the alarming consequences of fake accounts in perpetrating fraud, and underscore the importance of ensuring valid customer data:

In 2020, it was reported that the California Employment Development Department had paid out approximately $20 billion in fraudulent unemployment benefits. This fraud was primarily carried out through fake accounts, where scammers used fake identities to create and file claims for unemployment benefits.

In 2021, JPMorgan Chase paid $175 million to acquire Frank.com, a financial technology company that helped students fill out college financial aid forms and claimed over 4.25 million users. After the acquisition, JP Morgan’s marketing team performed a test email campaign and found that only about 20% of the accounts were genuine – the remaining 80% were fake accounts allegedly created by the founder.

The Impacts of Fraudulent and Fake Accounts

The consequences of customer account fraud extend beyond financial losses. Here are some key areas where this threat can hit your business:

Financial losses: Businesses can incur direct financial losses due to fraudulent transactions, as well as indirect losses from the costs of fraud investigations, legal proceedings, and refunds.

Reputation damage: Fraudulent activities can lead to a loss of trust among genuine customers, decreased customer loyalty and retention, and damage to a firm’s long-term brand image.

Operational challenges: Efforts to detect and prevent fraud increase the workload of employees, and causes more resources (both human and financial) to be allocated for fraud prevention.

Legal and compliance issues: Businesses can face legal actions if they are unable to protect customer data or fall victim to fraud, along with potentially heavy fines and penalties from regulatory bodies for non-compliance with security standards.

Technology costs: These costs include investments in technology to prevent fraud and fake accounts, as well as the ongoing update and maintenance costs of security systems to keep up with evolving fraud tactics.

Data integrity: Fake accounts can compromise the quality and accuracy of business data and reporting, impacting business decisions and strategy.

Customer experience: Additional security measures can sometimes lead to delays in service delivery, and customers may find enhanced security checks to be intrusive or cumbersome.

Global expansion: Businesses expanding globally face challenges with cross-border fraud originating from outside your country – for example, much of the California unemployment fraud mentioned above was perpetrated by criminals outside of the US. Different regions have a wide variety of fraud patterns and enforcement levels, making fraud prevention from foreign actors complex.

On top of these concerns, fraudsters are constantly evolving their tactics, making detection and prevention difficult. In particular, the misuse of advanced technologies such as AI by fraudsters to outsmart business security measures has ushered in a new level of risk, underscoring the importance of keeping ahead with updated automated solutions for fraud prevention.

Solutions to Fight Fraud

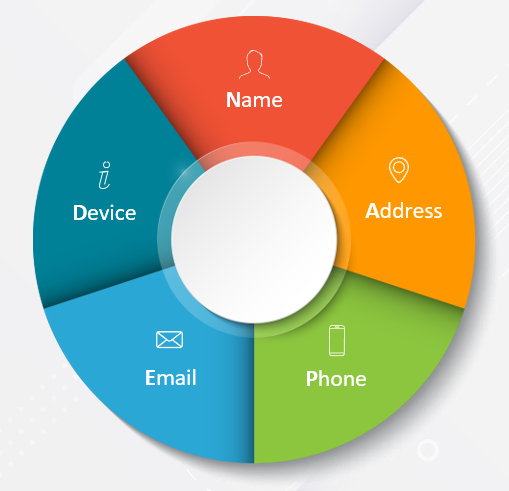

Customer Data Validation is instrumental in combating fraud through customer data accuracy, reducing the risk of false customer information in a business. This involves a comprehensive verification of core identity data points such as Name, Address, Phone, Email and IP, along with cross-referencing with reputable external databases to append critical details and confirm their validity.

Regular Customer Data Validation checks help identify unusual patterns or inconsistencies, serving as an early warning system for potential fraudulent activities. With Customer Data Validation, businesses can significantly enhance their defenses against fake accounts and online fraud.

In less than a second, you can verify a customer’s name, address, phone, email address and device against hundreds of trusted and authoritative data sources. Our Customer Data Validation services can be deployed at the point of capture as well as run periodically against existing data, to ensure your business’s customer data is not only genuine but remains accurate and up to date. Each core data point is both individually verified and corrected, as well as cross-validated against other data to ensure the accuracy and legitimacy of the customer.

Customer Data Validation Solutions

To effectively combat fraud through Customer Data Validation, our full suite of product-level solutions include:

- DOTS Lead and Customer Validation – derives and cross-validates over 130 data points, offering ‘Certainty’ and ‘Quality’ scores to differentiate between valuable customers and potential fraud quickly and confidently.

- DOTS Name Validation – flags potentially fraudulent entries by leveraging a complex suite of detection and verification filters, evaluating each element of a name to ensure the name is real.

- DOTS Address Validation – guards against fraudulent addresses using USPS and global postal data. With validation for over 250 countries and territories, you not only ensure accurate addresses but also programmatically expose fraudulent data and bad actors.

- DOTS Phone Insight – lets you leverage phone numbers to gain invaluable insights about your customers, which in turn can be used to detect and mitigate fraudulent activities.

- DOTS Email Validation – performs over 50 integrity checks and filters, resulting in a comprehensive evaluation of each email address’s fraud and spam risk as well as deliverability.

- Device / IP Address Validation – cross-references location data from IP addresses against customers’ billing and shipping information to help detect high-risk and potentially fraudulent transactions.

Let Us Help You Combat Fraud

Customer Data Validation is a powerful tool in the fight against fraud. By ensuring the accuracy and legitimacy of customer information, businesses can proactively protect themselves from fraudulent activities and maintain the trust of their genuine customers.

Whatever level of validation your business needs, implementing these solutions can make a significant difference in your fraud prevention efforts. Stay ahead in the battle against fraud by embracing the power of customer data validation. Let’s talk about how we can help your business.